Home » Cashless Payments Knowledge Hub » What is Borrow Now Pay Later? Should You Try It in 2025?

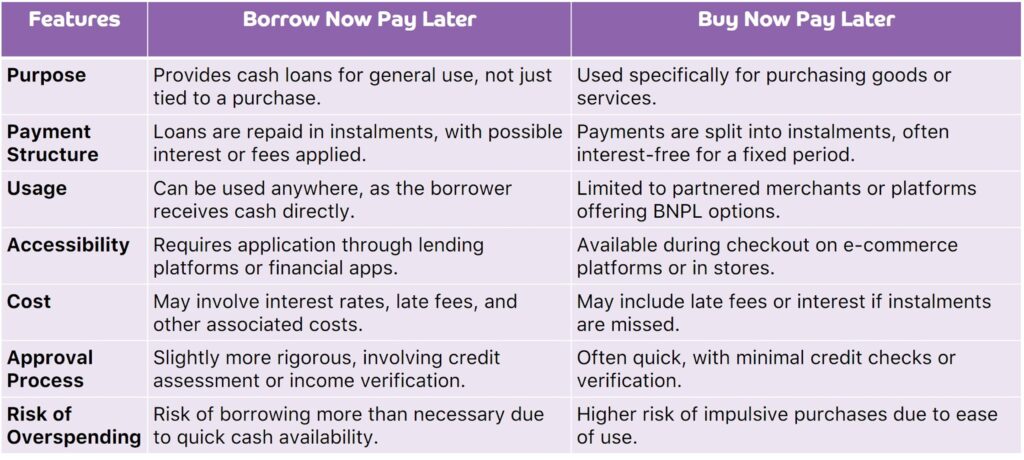

With the increasing demand for flexible payment solutions in the UAE, Borrow Now Pay Later services are expanding rapidly. Although Borrow Now Pay Later and Buy Now Pay Later services may appear similar, they are distinct from each other.

The adoption of buy now, pay later services is projected to grow at a compound annual growth rate (CAGR) of 12.4% from 2025 to 2029. Additionally, residents are increasingly seeking borrowing options that allow them to access funds immediately for emergencies or to provide extra financial support.

But is BNPL the right choice for you in 2025?

Let’s explore what is borrow now pay later, its features, potential risks, and alternatives to help you make an informed decision.

Borrow Now Pay Later (BNPL) is a financial service that allows you to access short-term credit for immediate needs. Unlike traditional loans, BNPL provides funds quickly, often without requiring extensive documentation or collateral.

While Buy Now Pay Later focuses on allowing consumers to split payments for purchases, Borrow Now Pay Later offers direct cash or credit for broader financial needs. BNPL for borrowing caters to emergencies or cash shortages rather than just retail purchases.

Also, read What is Cash Now Pay Later & How it Works

While BNPL services offer numerous advantages, they also come with risks:

The simplicity and accessibility of BNPL services can make borrowing too tempting for some. Since the process is often seamless and requires little effort, it may encourage individuals to borrow repeatedly without thoroughly assessing their financial capacity to repay.

Over time, this cycle of easy borrowing can lead to significant debt accumulation, making it harder to meet other financial obligations. What begins as a quick solution for an emergency can snowball into a financial burden.

While BNPL is often marketed as low-cost or interest-free, not all providers are transparent about additional fees. Late payment charges, administrative fees, or penalty interest rates can quickly inflate the actual cost of borrowing.

For instance, a missed repayment might trigger a series of fees that leave borrowers paying far more than the amount they initially borrowed. You must carefully read the terms and conditions to avoid unexpected financial surprises.

Timely repayments are critical when using BNPL services, as any delays or defaults can negatively impact your credit score. A lower credit score reduces your chances of accessing loans or credit cards in the future and may also affect your ability to secure better terms on mortgages or car loans.

BNPL services might seem harmless initially, but failing to meet repayment deadlines could leave a lasting mark on your financial reputation.

The convenience of BNPL services can promote impulsive borrowing and spending habits. When you can borrow funds instantly without fully considering the implications, it becomes easier to make unnecessary purchases or borrow more than you need.

This lack of financial discipline can lead to a strained budget, making it harder to manage essential expenses and achieve long-term financial goals. Over time, reliance on BNPL may undermine overall financial stability.

The best alternative to borrow now pay later is to get instant cash without incurring debt. Payit’s ‘Money on Demand’ service offers instant cash without any interest, and you get it with just a few taps on the phone from anywhere. Payit, powered by First Abu Dhabi Bank, offers ‘Money on Demand’. Eligible residents can request a cash advance and receive up to 50% of their salary directly in their Payit wallet.

Also, read How to Get Money on Demand without a Credit Score?

Borrow Now Pay Later is an innovative financial tool that offers convenience and flexibility. However, like any borrowing option, it requires careful consideration and responsible use. Weigh the benefits against the risks and explore alternatives like money-on-demand services if BNPL doesn’t align with your financial goals.

Can you borrow money and pay it later?

Yes, services like Borrow Now Pay Later and personal loans let you borrow money and pay it back in installments.

How can you get emergency cash in the UAE?

You can use platforms like Payit for quick and hassle-free access to emergency funds.

How can I borrow money and get it instantly?

Digital platforms like offering BNPL services provide instant cash with minimal requirements.

Does Payit give a loan?

Payit doesn’t offer traditional loans but provides alternative financial solutions like instant cash on demand. It is a mobile wallet app with which you can manage your payments and receive instant cash when you need it.