Home » Cashless Payments Knowledge Hub » What is Micro-Savings – How to Build Wealth with Small Daily Contributions?

Ever felt like your salary flew away from the account in just a blink? All the time, right? Well, daily expenses pile up before you can blink, especially in high-cost cities like Dubai and Abu Dhabi. And traditional savings often feel out of reach. So, is there any smarter, more realistic alternative?

Luckily, yes, micro-savings. But how does that work? Let us help.

Micro-savings simply means putting aside a very small amount of money regularly — daily, weekly, or with every transaction. This saving method is frictionless and consistent.

For example, if you save just ê 5 daily, by the end of the month, you’ve saved ê 150. In a year, that’s ê 1,800. Bump that to ê 10 daily, and you end up with ê 3,650 annually — without feeling much of a pinch.

Traditional savings often require lump sums. But micro-savings work well if you have tight budgets. They don’t demand discipline upfront; instead, they build it gradually.

In the UAE, the high cost of living makes micro-savings especially relevant. According to Numbeo, a single person in Dubai needs around ê 3,700 per month (excluding rent) to cover basic living expenses. Also,

Micro-savings fill this gap. They let you build financial security gradually without interrupting your daily routines.

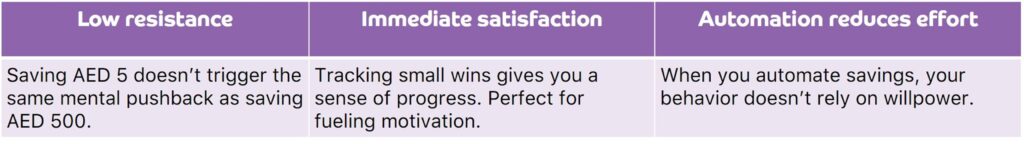

Human behavior is directly linked to financial success. According to James Clear, author of Atomic Habits, “You do not rise to the level of your goals. You fall to the level of your systems.” Micro-savings work because they build a system of consistency.

Here’s why it fits human psychology so well:

Wealth building starts with the habit of keeping money aside regularly. Here’s how small daily savings create long-term value.

Begin by pinpointing daily purchases you can skip:

Cutting one of these may give you ê 10-20 per day — ê 300-600 per month. That’s up to ê 7,200 per year – enough for a vacation, a new gadget, or a safety fund.

To help boost your savings, consider implementing a few simple cues – each time you make a digital payment, round up the amount and save the difference. Additionally, whenever you choose to eat at home instead of dining out, transfer ê 20 to your savings wallet.

Commit to saving a fixed amount whenever you decide to skip luxury items, such as clothing or electronics. These small changes can make a significant impact on your savings over time.

Schedule an automatic daily or weekly transfer into a mobile wallet. You can set ê 10/day, ê 50/week, or ê 100/month. Automation eliminates human error and builds financial momentum.

Saving becomes more powerful when you attach it to a goal. The motivation to stick with micro-savings increases. You can create goals like:

Use charts or savings apps to visualize your progress. Human brains respond to visual growth. It gives a dopamine boost that encourages continued action.

Slowly scale your daily savings. You can start with ê 5 daily and increase it gradually to ê 10-15. Occasional top-ups help you surpass your goals.

Once you’ve built a solid base, consider putting it in a fixed deposit. You can also buy gold in small units or start a SIP (Systematic Investment Plan). A safeguard against inflation.

You don’t need a higher income to start saving. All you need is a better system. And micro-savings is that system. They work because they don’t break your bank to build wealth. So, challenge yourself today to save just ê 10/day for one month. Download Payit now to build healthy financial systems. Watch what happens.

Saving ê 5 daily from impulse purchases into a digital wallet is a simple example of micro-saving.

A Systematic Investment Plan (SIP) allows you to invest small amounts regularly in mutual funds to build wealth.

Combine consistent saving habits with smart investments and avoid unnecessary debt.

Savings can be redirected into goal-based investments for growth through compounding and market returns.