Home » Cashless Payments Knowledge Hub » Why is Gold Rate in Dubai So High Right Now? A Look at What’s Changed Over the Years

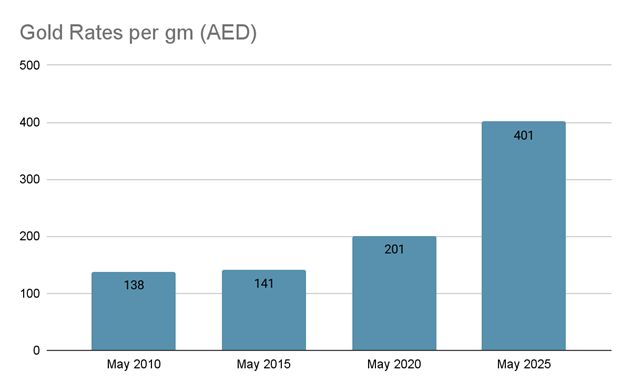

It’s hard to find someone who doesn’t have or want to have gold. But why does the price tag on a plain 24-karat coin in Dubai now read closer to ê 400 per gram when it was barely ê 140 a decade ago? What has changed and what hasn’t for gold in Dubai? Let’s decode.

On 10th June 2025, Dubai’s published retail rate for 24K gold stood at ê 401 per gram, while 22K at ê 371.50 per gram. Local shops usually add a small making charge plus a retail premium of roughly 4-5 dirhams per gram over the international spot rate.

A whopping jump of roughly 184% since 2015 and 100% just since 2020.

These are the major reasons gold prices are through the roof:

Worldwide bullion is trading near US$ 3,330–3,350 per ounce after repeatedly topping USD 3,300 in May. Because the dirham is pegged at 3.6725 to the dollar, every increase in dollar price instantly reflects in the UAE base rate for gold.

Central banks added 1,045 tonnes to official reserves in 2024. And that extends their buying streak to 15 years! Heavy sovereign demand tightens supply and underpins prices.

Cash in the bank isn’t growing fast enough. UAE banks currently offer interest rates between 3.5% and 4.25% per annum on fixed deposits. Inflation in the UAE is moderate. But still, it hovers around 2.5% to 3%. Means real returns are low, sometimes barely 1%. Gold, while it doesn’t pay interest, holds value globally. When inflation eats into currency buying power, especially in uncertain times, gold acts like a store of wealth for you. And thus, people turn to invest in gold. So, hiked demand. Hiked prices.

Ongoing wars, plus trade friction among major powers, keep risk appetites fragile. Each headline nudges more money into the yellow metal for optimal financial planning.

When the U.S. imposes tariffs (especially on major economies like China), it often triggers global trade tensions. As a result, investors worldwide — including in the UAE — move money into safe-haven assets like gold.

Add it up, and the counter price naturally sits a few dirhams above the quoted spot.

If you’re hunting for the best deal, zero making charges gold can be your solution. This means you pay no extra fees for craftsmanship or design – you only pay for the gold itself. It’s a transparent way to buy, often available in select shops or during special promotions, so keep an eye out if you want to avoid those extra costs.

Gold in Dubai is dearer today because global prices are near all-time highs. The dirham follows the surging dollar tick for tick. And the UAE channels remarkable demand through a finite supply pipeline. Will the price cool soon? Only if the fear gauges fall, real yields climb, and central banks hit pause. Until then, expect those LED boards in Deira to keep inching upward.

Here’s something exciting for Payit users. Payit Wallet users will earn a guaranteed ê100 Kalyan Jewellers voucher. But how? Just keep ê 1,000 or more in their Payit wallet from May 20 to June 20, 2025. That’s all. It gets better: redeem your voucher at any Kalyan Jewellers store by July 31, and you’ll automatically enter a raffle draw to win a 5-gram gold coin.

There are 10 coins up for grabs. Kalyan Jewellers will pick winners in August’s first week. No complicated forms. No hidden fees. Just maintain your wallet balance, redeem the voucher, and you’re in.