Home » Cashless Payments Knowledge Hub » Your Guide to Successful Online Money Transfers: Do’s and Don’ts to Remember

Online money transfers have become integral to your financial routine, whether sending money to your home country or simply paying the bills. The ability to send money across borders with a few clicks has brought unprecedented convenience to our lives. However, with this convenience comes the responsibility to navigate the digital domain safely and securely.

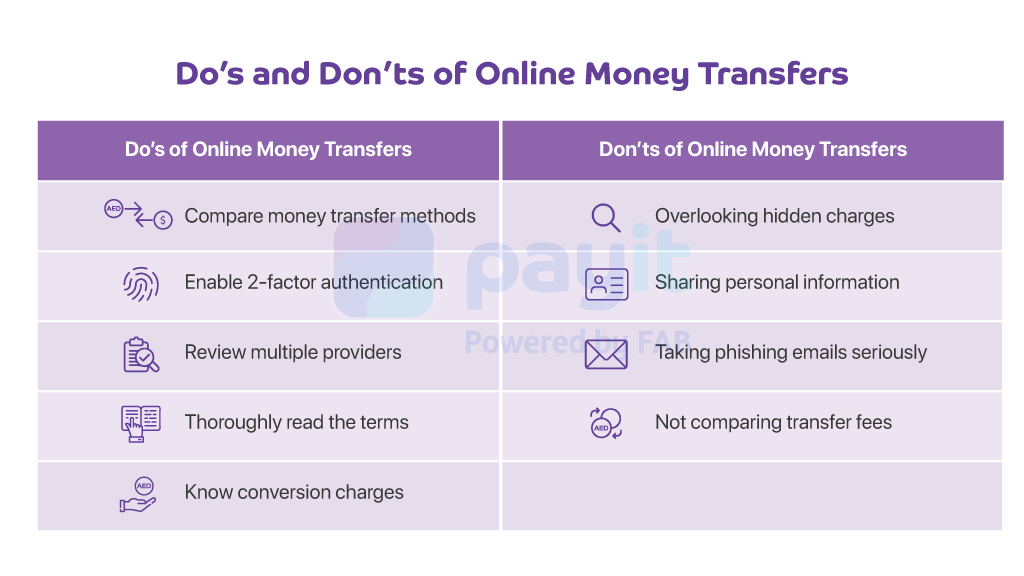

Following a set of do’s and don’ts is essential to ensure your online money transfers are successful and worry-free. This comprehensive guide will walk you through the best practices to ensure your online money transfers are smooth and secure.

Let’s look at the things that you should do while transferring money using online methods such as wire transfers, wallet-to-wallet transfers, etc.

Before initiating an online money transfer, take the time to compare different money transfer methods. Each method may have varying fees, exchange rates, and processing times. Also, some ways, like digital wallet transfers, are the best for local or international transfers, while specific methods will be the best only for cross-border transactions.

Opt for platforms that offer two-factor authentication (2FA) as an added layer of security. 2FA requires you to provide a second piece of information, such as a verification code sent to your phone and your password.

Begin your online money transfer journey by researching and selecting well-established and reputable platforms. Look for platforms that employ advanced security measures and have positive user reviews.

Also, read Avoid These Most Repeated Mistakes While Sending Your Money Abroad.

Before finalizing an online money transfer, carefully read and understand the terms and conditions of the transfer service. Pay attention to fees, exchange rates, transfer limits, and any potential hidden charges. Being well-informed ensures transparency and prevents surprises down the line.

When making international money transfers, be aware of conversion charges associated with currency exchange. Understand the exchange rate being offered and any additional fees for converting your funds. Being informed about conversion charges helps you make cost-effective decisions for your transfer.

Let’s look at the things you should not do while transferring money online, whether a simple bill payment or remittance transfer.

Failing to review the fine print can lead to unexpected costs. Be vigilant about hidden charges, such as service fees, currency conversion costs, or intermediary bank fees, which can significantly impact the final amount received.

Neglecting to compare transfer fees across different platforms to avoid unnecessary expenses. Compare rates to ensure you get the best deal, including upfront fees and potential hidden costs.

Refrain from sharing sensitive information with unverified providers. Only provide personal and financial details to reputable and trusted money transfer platforms to avoid potential data breaches or fraud.

Stay cautious of phishing emails posing as legitimate transfer providers. Never click on suspicious links or provide personal information in response to such emails. Taking phishing attempts seriously safeguards you from falling victim to scams.

To confidently and securely perform online money transfers, following these do’s and don’ts is essential. Remember that your financial well-being is ultimately up to you, and taking proactive measures to protect it is crucial in today’s digital age. Stay alert, keep yourself informed, and take control of your financial transactions through empowerment and knowledge.

Send money online in over 200 countries within just a few taps on your phone. Download the Payit mobile wallet app and get the best transaction rate for your international remittances.