Home » Cashless Payments Knowledge Hub » How to Get Money on Demand without a Credit Score?

There are times when you need instant access to cash, be it for any purchase or emergency. In such a time, money on demand can prove highly beneficial. With Payit, getting money on demand has become easy. It is a special feature offered by Payit, a digital wallet powered by the First Abu Dhabi Bank (FAB) to help its users get cash in advance.

In this article, we will cover how to use this feature and the eligibility requirements in detail.

In the UAE, there are several options for accessing instant money, ranging from personal loans from banks to more informal methods. Many banks offer personal loans with fast processing, often within 24-48 hours, depending on credit history and employment status.

Alternatively, if you have a credit card, you can take a cash advance directly from an ATM, though this often comes with higher fees. Employer-provided salary advances are also common in the UAE, allowing you to receive a portion of your paycheck in advance, repaid through future deductions.

Pawn shops and gold loans allow you to secure funds using valuables, while peer-to-peer lending platforms like Beehive provide quick access to funds for businesses.

However, most of these options require a good credit score and have a lengthy process that may not provide instant money.

A bad credit score indicates a lack of reliability, making it harder to secure financial assistance and often resulting in higher interest rates. Conversely, a good credit score can help obtain loans at preferable rates. However, it is still possible to access cash without a good credit score through options that don’t require credit checks.

Let’s see the best option for instant money without a credit check.

Payit, a digital wallet service, offers instant money so that any short-term cash demand can be met without stress. This service by Payit is called ‘Money on Demand,’ and it is available to Ratibi Card holders only.

Cash on demand allows you to access funds instantly when needed, providing a convenient alternative to traditional banking methods.

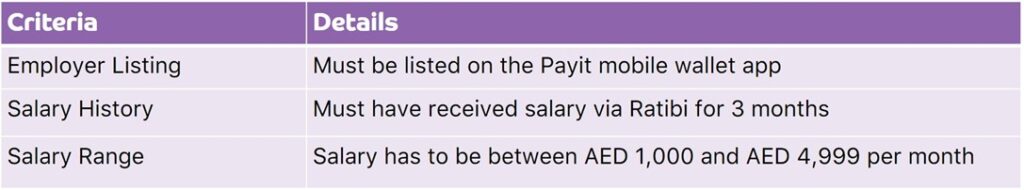

The eligibility criteria for accessing the Money on Demand feature through Ratibi salary cards include:

You can request up to 50% of your salary without credit history or collateral. Also, no additional interest charges or fees are charged. That amount is usually deducted from the Cash on Demand sum, and then the rest is credited to your account.

The cash received is automatically deducted from your Ratibi account on the first day of the following month. For example, if you request cash on demand on November 15th, it will be debited from your Ratibi account on December 1st.

Also, read Unlocking Money on Demand Feature Through Ratibi Salary Cards

You must first set up your account to access money on demand through Payit. This process involves a few simple steps, and you will be able to use the instant advance cash feature of your Payit digital wallet.

Once linked, you can use the ‘money on demand’ feature to receive up to 50% of your salary as an advance from your employer.

Instant cash loans in the form of cash on demand can be useful in various situations.

You can receive 50% of your salary in advance using Payit’s cash-on-demand feature. This instant access to funds becomes important when facing unexpected expenses or urgent financial needs. You can receive the requested money in your mobile wallet within seconds without any documentation or background checks.

The money-on-demand feature allows you to get instant cash by providing flexible access to funds. With this, you can meet any short-term cash shortage. The amount you request through instant cash is recovered from your Ratibi card on the 1st of the following month. This automatic repayment system helps you avoid the burden of remembering repayment dates.

As you open an account with Payit for money on demand, you can access Payit’s features, including receiving your salary directly in your mobile wallet. This eliminates the need for a traditional bank account, which often requires a minimum balance. With the Payit app, you can manage all your banking needs with just a few clicks, from checking your balance to making payments and transferring money internationally.

When you need urgent money, you may not have a good credit score to avail of any credit facilities. The best option to get an instant cash advance is through ‘Money on Demand’ by the Payit wallet app, where you don’t need any credit score to receive money.

Download the Payit app to get instant money and manage your payments more efficiently.