Home » Cashless Payments Knowledge Hub » 5 Tips Before You Convert Currency for International Travel from UAE

When planning an international trip, currency exchange often tops the checklist. While it might seem straightforward to swap your local currency for the one used in your destination, the process is more nuanced than it appears. Rushing into currency conversion without understanding the nuances can lead to unnecessary expenses and hassles.

This blog will help you prepare for currency conversions and explore alternative ways to manage international payments effectively.

Let’s dive in!

Carrying some foreign currency in cash is common for international travelers, but relying solely on cash is not always ideal. Here’s how you can make your travel financially efficient while avoiding costly mistakes:

Exchange rates fluctuate daily, and timing your currency conversion can save you a significant amount. Use apps or online tools to track exchange rates weeks before your trip to identify the best time to convert your money. Avoid converting when rates are unfavorable, and take advantage of rate alerts offered by some currency exchange services.

Prepaid travel cards like Letsgo Payit offer a practical alternative to carrying cash. These cards allow you to preload funds in your local currency and use them to make payments in international currency. They are safer than cash and widely accepted at international merchants and ATMs.

Credit and debit cards often come with travel-related perks, such as lower foreign transaction fees or cashback offers. Research your card’s benefits before traveling and check if your bank offers travel-specific deals. Some cards waive conversion fees or offer better rates, making them a cost-effective payment option abroad.

Currency exchanges involve hidden fees, including service charges or commission fees. Before converting your money, know these costs to ensure a fair deal. Look for exchange services offering transparent pricing or no-commission options.

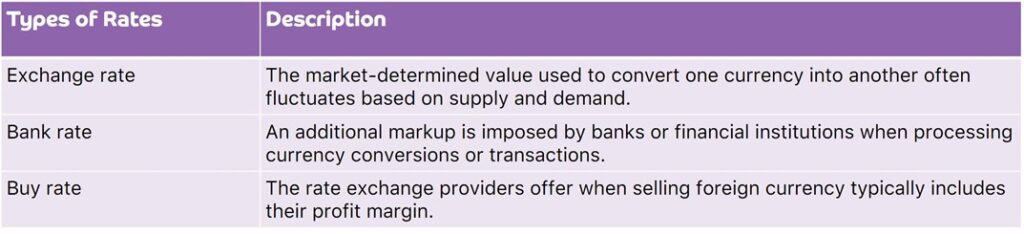

Typically, a currency conversion includes these costs:

Also, read Understanding Exchange Rates and Fees

Airport currency exchange counters often charge higher rates due to convenience. While exchanging a small amount for immediate use is acceptable, avoid converting large sums at the airport. Instead, opt for a local exchange house or use an ATM at your destination for better rates.

Managing finances during international travel can be stress-free with the right tools. The Letsgo Payit Card is a game-changer for UAE travelers looking for convenience and cost-efficiency. Here’s why:

Also read: 6 Tips to Save Your Money on Foreign Exchanges

Preparing for currency conversions and payments abroad is essential for a hassle-free international trip. If you want to avoid the risk of carrying cash, the best way out is to use the internationally accepted cards. For UAE travelers, the Letsgo Payit Card is an excellent choice for managing international payments efficiently.