Sending your money home, especially when you are an expat in the UAE, isn’t as smooth as you think. You need to look for a competitive exchange rate that helps you send money safely, conveniently, and at an affordable price.

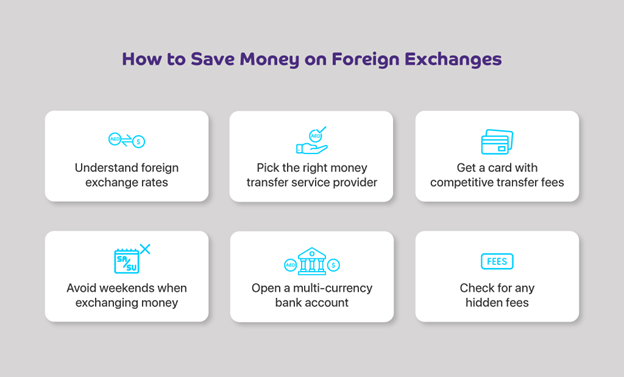

So, let’s go through six excellent tips that can save you some cash on foreign exchanges and make your international money transfers more reasonable.

Every penny you send to your home country or any other foreign country costs you some fees. If you don’t understand how these foreign exchanges work, you may lose a lot of money by selecting the wrong method to send money abroad.

Here’s a list of practical tips to implement and save money while sending money internationally.

You need to learn how foreign exchange rates work and track at which rates you send money. This way, you will better understand when the foreign exchange rate is cheaper or if the exchange rate keeps growing; you may decide to send more before and less after that.

Also, learn how different countries’ exchange rates are determined, what factors influence their movements, and then you send money abroad. This will help you save money for your international money transfers.

Also, read Understanding Exchange Rates and Fees: Cheapest Way to Send Your Money Home.

You can send money abroad through multiple channels, such as bank transfers, mobile wallets, foreign exchange houses, etc. While bank transfers are costly due to multiple charges (transfer fees, exchange charges, receiver bank fees, etc.), mobile wallets and money exchange houses could be cheaper alternatives.

Mobile wallets like Payit can offer instant money transfer services with competitive fees to eligible countries, including India, Philippines, Nepal, etc. Not only that, but with the Payit wallet, you can also shop, travel, and dine at your favorite places and enjoy amazing deals and offers with the Letsgo Payit Card.

Certain cards offer competitive exchange rates for the destination countries. For example, the Letsgo Payit Card often runs campaigns where the transfer fees on international transfers to certain countries are waived. Similarly, certain credit cards offer better rates to send money internationally.

However, credit cards could cost you a lot of money or may have certain hidden charges. Thus, you must select the cards wisely when you want to save money on international money transfers.

Payit app also enables you to top up your international mobile sim cards seamlessly with a safer and more convenient method.

Currency exchange rates fluctuate daily, and it’s commonly observed that rates tend to be less favorable over the weekends. The reason? Banks charge a slightly higher rate on Monday mornings because they are uncertain about the new rate and want to safeguard against unexpected market shifts when the market reopens.

To get the best rates, plan your currency exchanges during the weekdays. This might require some pre-trip planning, but the savings can make it worthwhile.

When you have a requirement to send money internationally quite frequently, consider opening a multi-currency account. This will save you money on the transfer fees since you already have accounts in different currencies, and you can easily use that currency to send money to the respective countries.

Banks also offer mobile banking services, and through that, you can manage your money more efficiently and move funds from one account to another in different currencies.

Last but certainly not least, always be vigilant and check for hidden fees. Some currency exchange services may advertise attractive rates but compensate for them with hidden charges or unfavorable terms. Before making any transactions, it is essential to carefully read the fine print and inquire about any additional fees that may apply. It’s always a good idea to stay informed about potential charges and make wise decisions to avoid surprises.

Knowing the fees associated with financial transactions, such as withdrawals and card usage, is crucial. Learning about potential hidden costs can help you make informed decisions and avoid surprises when reviewing your bank statements.

Saving money on foreign exchanges requires planning, awareness, and choosing the right financial tools. You can save money on your foreign exchange by selecting the most efficient and cost-effective ways to send money internationally.

Download the Payit mobile wallet app to send and receive money from anywhere, anytime.