Home » Cashless Payments Knowledge Hub » 5 Common Mistakes People Make While Applying for Online Loans

Applying for a loan might be a daunting task for many, but not for those who research thoroughly and avoid common mistakes. Mistakes made in the financial world cost you more money than the mistakes you make in other areas.

In an era where you get instant personal loans within a few clicks on online money lenders’ websites, it becomes riskier for you to get trapped.

Fortunately, we have done some homework for you, so you don’t need to repeat the mistakes made by others. Let’s look at people’s most common mistakes while applying for an online loan.

The rising inflation rates by the US Federal Reserve have made the UAE government increase the loan interest rates. According to a forecast, the interest rates may go as high as 5.21% by the end of 2023.

Thus, it becomes crucial for you to carefully consider your loan applications and try to avoid mistakes that people usually make while borrowing money online.

Your credit score represents your creditworthiness by observing your existing liabilities, regular money inflow, and spending behavior. Every lender, be it a bank or an online loan provider, would check how financially sound you are.

And credit score is the number that tells them how reliable you will be in repaying the loan if they lend you their money. Thus, you must be careful while applying for a loan and check your credit score.

Your credit score is calculated based on your spending pattern (how regularly you pay your bills) and your existing obligations (any existing loan or credit facilities, including credit cards). Moreover, the higher the credit score, the better interest rates you will get.

Thus, if your credit score is low, try to improve it first rather than applying for a loan. This will save you lots of money you may burn by paying higher interest rates.

Also, read No Credit History? 4 Ways to Get Money Without a Credit Check

| Simple Tips to Improve Your Credit Score: Be regular while paying utility and other monthly bills.Pay off your existing debts.Clear all other outstanding bills or amounts.Pay credit card dues on time.Try to keep your credit utilization low. (aim for 30% or less)Review your credit reports frequently. |

Don’t rush to apply for a loan because one money lender offers extra benefits or offers the lowest interest rate. Check the loan terms in detail and see if they match your requirements.

Not all money lenders will have the same conditions or terms when they lend to you. From interest rates and loan terms to loan processing fees, many aspects differ for different lenders.

Thus, check the below points as a minimum when considering a particular lender for your loan application:

This is one of the most common mistakes people make while borrowing money online, and it is fair to make this mistake. When we want to buy a house, we will check multiple houses at different locations, but it does not work for loans.

Yes, you need to check other options, but do not rush to apply or submit your information before you have thoroughly checked about the lender.

If you apply for loans on different online money lenders’ platforms, it will have an adverse effect on your credit score. Every money lender you apply to will check your credit score; when multiple people review the score, it can bring it down by more than 5 points.

So, explore all options but refrain from applying straight away.

It is a different ball game when applying online for instant loans. Checking the loan terms carefully will help you find hidden charges or if the lender has different repayment terms than you thought.

For example, you may have noticed the interest rate the lender offers, but the terms and conditions will tell you whether that is typically charged or has a compounding effect.

Lenders may fool you by showing a lower interest rate, but in the terms, they add ‘charged with compounding effects’, which you may end up paying more than the principal amount.

Also, read Cash Now Pay Later: What is it and How Does it Work?

You may think online money lenders are least bothered about your income and focus more on customer acquisition. But, it is the biggest myth. Although few money lenders lend money without proper KYC, most lenders will check your income and credit score hard.

If you fake your income and, by chance, get the loan, you may be in serious trouble if the money lender finds out that you lied about your income, including criminal charges.

Thus, refrain from faking your income or debt details from the lenders for your good.

Understanding the above mistakes and their consequences will help you make informed decisions and save you from getting trapped. Let’s check what you should look for in an online money lender.

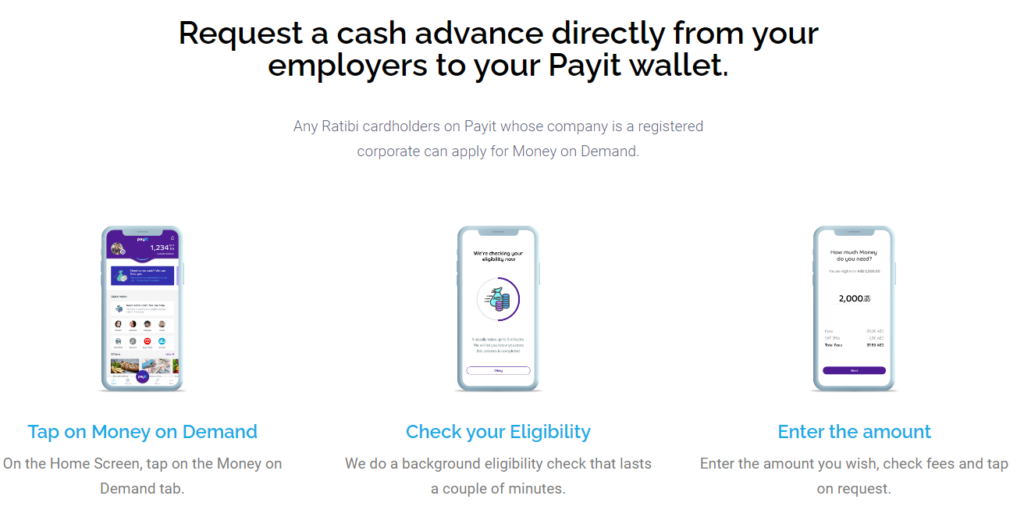

You can get instant cash in your mobile wallet through Payit’s ‘Money on Demand’ feature if you are a ratibi card holder. You need to simply click on the ‘Money on Demand’ tab, enter the amount required, review fees charged, and confirm the request.

You will receive the requested money in your mobile wallet within a few seconds without any documentation or background checks.

Get faster access to cash, pay bills, shop online, and more with the Payit mobile wallet app.