Home » Cashless Payments Knowledge Hub » Navigating the Crypto Market: Understanding Exchange Types

Trading volumes of crypto have reached $139 million. In fact, 97% consider digital assets like cryptocurrency a safe way of investment.

Such a high inclination towards cryptocurrency makes the need for platforms to buy, sell, and trade these assets important.

This is where crypto exchanges come into play. In this blog, we’ll explore the different types of crypto exchanges available in the market today and how they function to provide users with access to the world of cryptocurrency.

An organization that facilitates the exchange of digital or cryptocurrency for other assets is known as a cryptocurrency exchange or a digital currency exchange. There are three types of crypto exchanges —

Let’s elaborate on these further:

A centralized cryptocurrency exchange is like the regular stock exchanges you’re used to, and it’s where buyers and sellers come together. And the exchange acts as a middleman.

Here are some characteristics of CEX:

Also, read The Digital Currencies in UAE

Here’s how a centralized exchange typically works:

And that’s it! You just bought or sold crypto on an exchange.

A decentralized cryptocurrency exchange is all about keeping things accurate to the philosophy behind the crypto industry.

With a DEX, you don’t have to rely on an intermediary (a middleman) to hold your funds.

Instead, it’s a marketplace where buyers and sellers come together and process transactions directly. In other words, it’s a peer-to-peer trading platform. Here are some traits of DEX:

But as the crypto industry continues to grow and evolve, DEXS may become more widely used.

This could increase their overall popularity and hence liquidity.

Also, read Digital Payments Trends in UAE to Look For in 2023

Hybrids aim to bring together the best of both worlds from centralized and decentralized exchanges. Here’s what defines hybrid cryptocurrency exchange:

The first hybrid exchange was called Qurrex, and it was launched back in 2018.

The Qurrex team came together in 2016 with experts with years of experience in the forex markets.

They all saw the potential of combining the best practices of traditional exchanges to create a new generation of cryptocurrency exchanges that blended both centralized and decentralized elements.

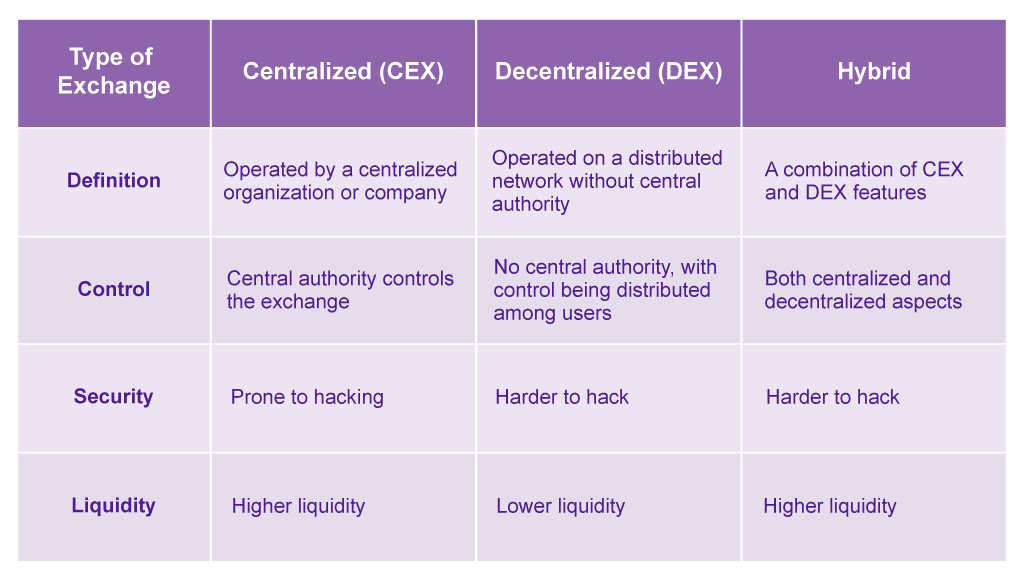

Here’s a table explaining the different categories of crypto exchanges:

Remember, these are generalizations; each platform may have different features and characteristics.

The increasing popularity of cryptocurrency has led to a growing need for reliable and secure platforms to buy, sell, and trade these assets. Three main types of crypto exchanges are available: centralized, decentralized, and hybrid.

While centralized exchanges offer high liquidity, they are vulnerable to hacking attacks.

Decentralized exchanges, on the other hand, prioritize security and user control but often have lower liquidity. Hybrid exchanges blend the best aspects of centralized and decentralized exchanges to provide users with liquidity and safety.

The crypto industry continues to evolve. Seeing how these exchanges develop and what innovations will emerge will be interesting!

Finally, you can now download Payit to enjoy exclusive offers, benefits, plus go for shopping, dinning, and paying your bills on-the-go with our new Letsgo Card, which is a virtual card stored on the app on your phone, while it also allows you to receive a physical card.