Home » Cashless Payments Knowledge Hub » 5 Common Mistakes Most Parents Make While Making Financial Decisions

We all make mistakes and learn from them, but money mistakes are too costly that you must avoid them. Financial decisions need patience and a lot of your time to think about whether a decision is good for you and for your kids.

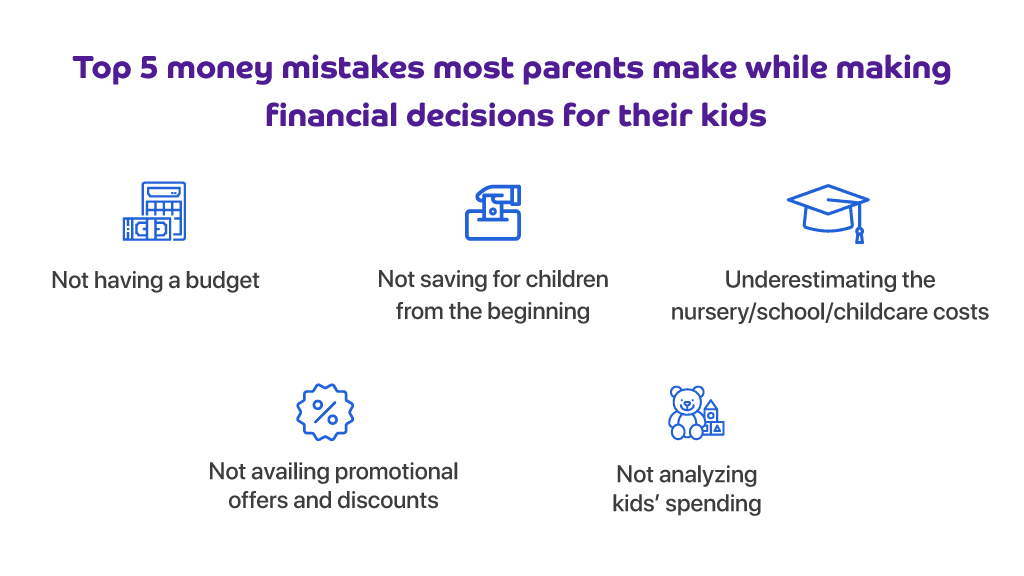

You can avoid these mistakes by planning your finances well in advance. Here are 5 common mistakes every parent makes while making financial decisions for their kids.

Parents have additional responsibilities of looking after their children and making their financial decisions for everybody’s good. Hence, if you make a mistake in planning your kids’ finances, it affects your and your children’s financial future.

Thus, let’s avoid these mistakes, as we have listed the most common money mistakes you may make while making financial decisions for your children.

Many parents don’t plan a budget for their children’s expenses. Remember, from babysitting, sending kids to school, and growing up, every phase has its own set of expenses, and you must plan them in advance.

Not having a budget will only complicate it for you, and you will spend way more than you were required to. When your household income may have been affected because one of the parents may have to look after your kids actively, you need a budget for every penny you spend for them.

Saving money from now for your children’s future educational and other expenses can help you avoid going into debt later on. Many parents avail of educational loans because it is convenient and allows you to pay the expenses in installments.

The money saved now will accumulate to more significant savings, which will help you avoid the debt trap. Hence, not saving for your child’s expenses could be one of the biggest mistakes you might be making.

Almost everything is expensive and over-priced. Especially kids’ school/nursery supplies and fees are more costly than before. The kind of customized and value-added services offered by these schools, nurseries, and universities will obviously be high for these costs.

Thus, you cannot underestimate these expenses, and you must consider how much of your income will be spent on these costs.

The merchants provide discounts and promotional offers on kids’ clothing, essential school supplies, school admission fees, etc. You can not ignore these if they are genuinely reducing your costs. Not availing of these offers will increase your expenses, and you will lose a chance to reduce the costs.

Not Analyzing Kids’ Spending Behavior

This may sound stupid, but you need to review where and how your kids spend the money you give them. The pocket money is meant to be provided for spending. And thus, most parents don’t bother about where their kids spend them.

You can make better financial decisions if you know how your children spend their pocket money. For example, your kids may spend all their pocket money on eating out or playing online games.

If you know this, you may prefer to allocate pocket money so that there is a limit on eating out and playing games online.

Apart from these, not having an emergency fund and not allowing your kids to plan their expenses are also some of the other mistakes many parents make. Let’s avoid these mistakes and be better financial planners for yourself and your children.

Let’s see some tips to help you make better financial decisions for your children.

While it is essential to learn from your mistakes, you need to make mistakes first. Or, you can learn from other’s mistakes. Below are some tips derived from the mistakes others made, and you can benefit by staying away from those mistakes.

Thus, you need to revisit the way you make your financial decisions and see if you are not making these mistakes to stay away from them and avoid extra costs. Plan in advance, spend wisely and start saving to be a better financial decision-maker.

Download the Payit e-wallet app to simplify your payments and avail exciting offers and get a chance to win amazing prizes.