Home » Cashless Payments Knowledge Hub » Cash Out by Payit: Getting Cash Now Using Your Smartphone

As a card-dominated country, UAE has 63%of its total population as credit cardholders. They use credit cards for shopping, payments, and even to withdraw money. Although debit cards are used to withdraw money from Automated Teller Machines (ATMs), credit cards also facilitate withdrawing cash at a specific cost.

But what if you need cash and don’t remember the PIN?

What if you forgot to carry your card?

What if you lose your card and need cash urgently?

Payit’s ‘Cash Out’ feature lets you instantly withdraw cash using an app on your smartphone where you don’t need to remember the PIN or carry the card.

Let’s check what is ‘cash out’, how to use it, and how you can get cash now using your phone.

‘Cash Out’ by Payit is a unique mobile wallet feature that allows you to withdraw money from ATMs and transfer money to a local bank account. It is the smartest way to get instant cash even when you don’t have a credit/debit card.

So, how does it work if you don’t need a credit/debit card to withdraw money? Through your smartphone!

Let’s understand Cash Out’s key features.

Thus, it provides convenience, speed, and a smart way of receiving instant cash in a few taps on your mobile phone. Let’s see why it is the most convenient way to withdraw money from ATMs.

Also, read Cash Now, Pay Later: What is it and How Does it Work?

After the unprecedented global event happened in 2020, everyone started giving preference to contactless activities such as contactless delivery of items, contactless payments, etc.

Payit’s ‘Cash Out’ feature enables you to withdraw cash without touching the ATM or inserting your card inside the ATM.

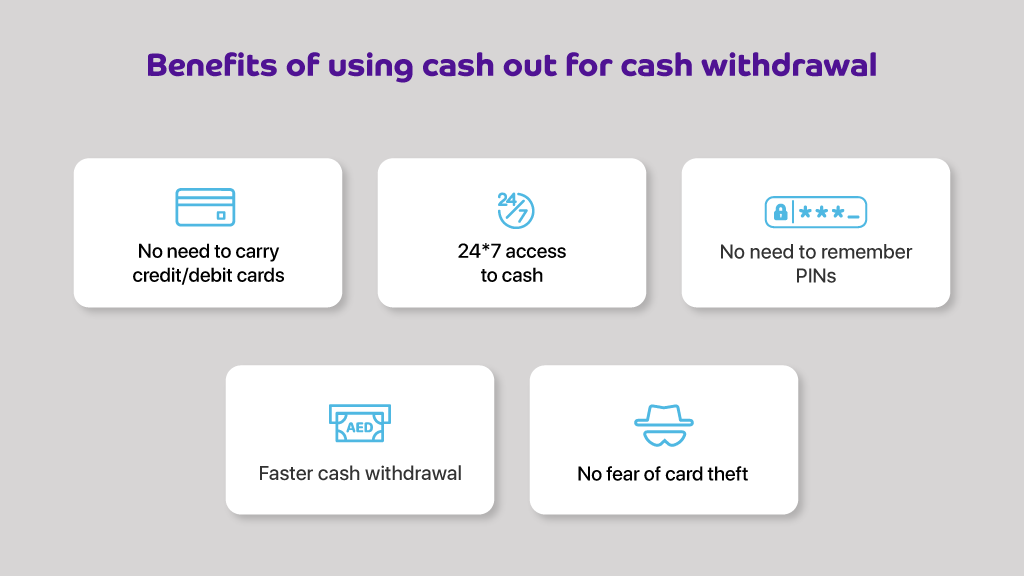

‘Cash Out’ does not need your physical credit or debit card to withdraw cash from the ATM. You just need to download the Payit mobile wallet app on your mobile, create an account, top-up your Payit wallet, and you can withdraw cash using the app on your phone.

You can withdraw money anytime using the app from your phone. Hence, you get 24*7 access to instant cash whenever you want. Your mobile wallet is enough to help you gain quick access to cash.

When you use Payit’s ‘Cash Out’ to withdraw money, you don’t need to remember card PINs because you receive an SMS code on your phone that you need to enter to withdraw money. Thus, no more PINs or passwords to remember when you use the Payit app to withdraw money.

With ‘Cash Out’, you can withdraw money with just a few clicks on your phone. Thus, you don’t need to touch the ATM machine’s screen or select other options that usually appear on the screen.

Since you don’t need to carry any debit/credit cards, you don’t have to worry about its theft. Your cash withdrawal remains safe, and you can easily avoid card theft.

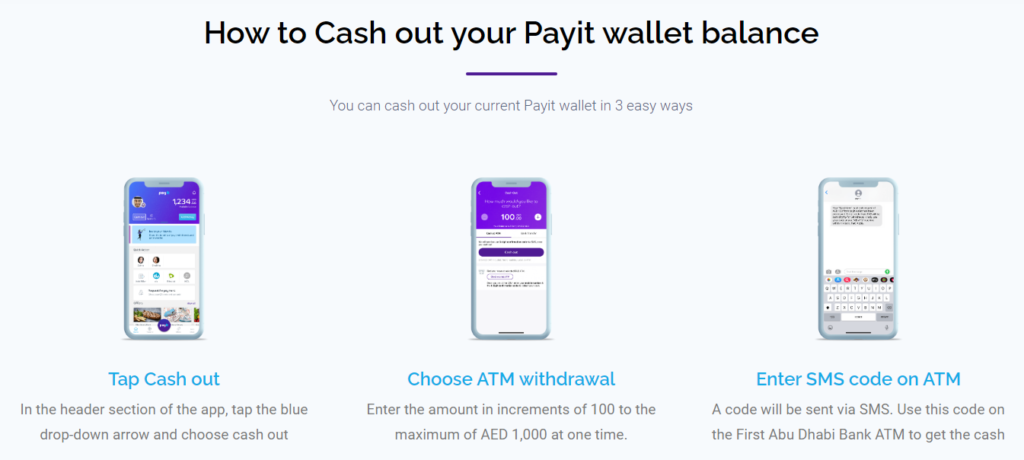

You can withdraw money from any FAB ATM with a few taps on your Payit app. Let’s see how you can do it.

Get instant cash now using Payit mobile wallet app on your phone and use it to transfer money to a local bank account quickly.