Home » Cashless Payments Knowledge Hub » UAE’s Top Fintech Trends to Look for in 2023

The United Arab Emirates (UAE) has emerged as a frontrunner in the global fintech landscape, with its market exhibiting remarkable growth potential, size, and innovation.

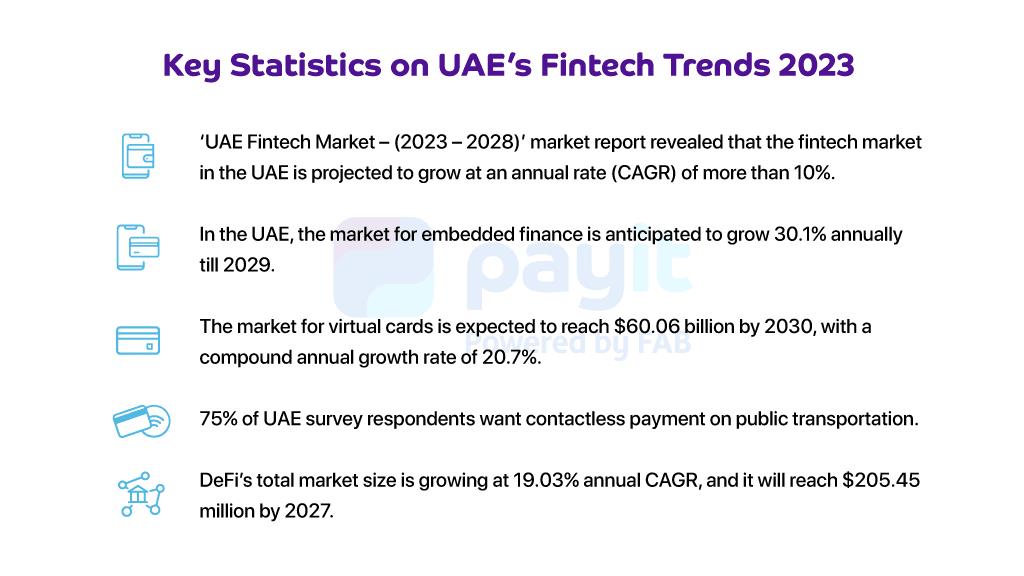

A market research report called “UAE Fintech Market – (2023 – 2028)” has revealed that the fintech market in the UAE is projected to experience a compound annual growth rate (CAGR) of more than 10%.

The Fintech industry in UAE is poised for future growth thanks to several major growth drivers. These include,

In this article, we will discuss the significant fintech developments that will influence the financial sector of the UAE in 2023. We’ll focus on the latest progress and initiatives introduced at the Dubai Fintech Summit.

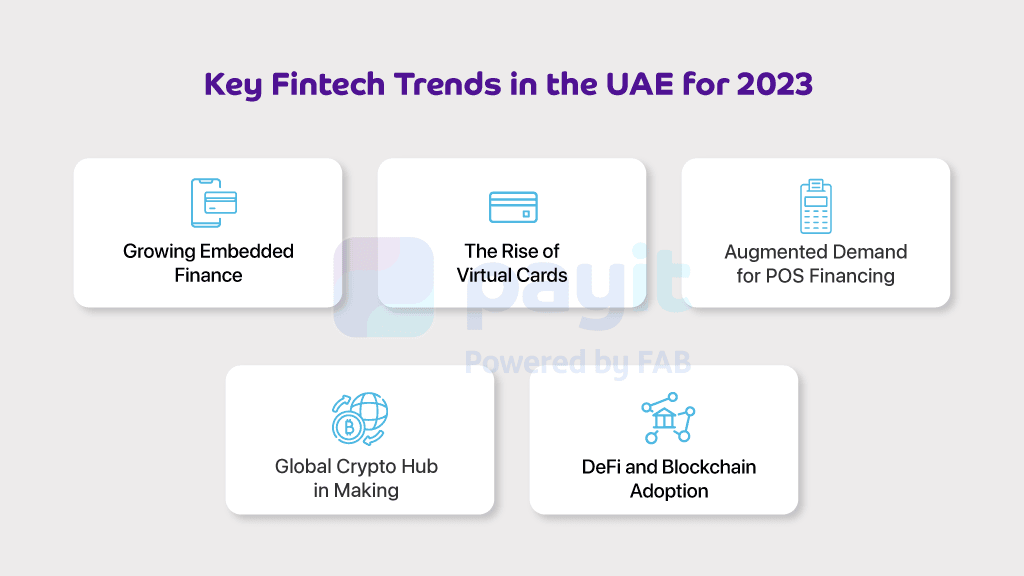

The UAE is becoming an ideal location for launching and growing a start-up due to the growing digital economy and regional innovation efforts. Let’s look at the key fintech trends to look for in 2023 in the UAE.Embedded finance integrates financial products like loans and insurance into non-financial business infrastructure to serve customers well without interference from traditional banking institutions.

For example, when you book a flight ticket, the flight company will also sell you travel insurance. This is a classic example of embedded finance with a non-financial company.

In the UAE, the market for embedded finance is anticipated to grow 30.1% annually till 2029. Below are some popular types of embedded finance products:

| Product | Description |

| Embedded Payments | They integrate digital payment options within non-financial company platforms, allowing customers to pay seamlessly without leaving the website or app. Examples: instant payments and digital wallets like Payit. |

| Embedded Insurance | It is when insurance is sold with another product or service, usually at the point of sale. Example: add-on insurance for electronics or for traveling. |

| Embedded Lending | It integrates lending services into non-financial platforms or offerings. Examples: BNPL, SME financing, and co-branded credit cards. |

| Embedded Investing | It offers investment and wealth management services from a digital platform by non-financial companies and their products or services. Example: ride-hailing companies like Careem. |

Also, read UAE’s Digital Payment Trends to Look for in 2023

Virtual cards are the electronic versions of physical debit or credit cards, which can be used the same as a physical card as it carries a CVV number, cardholder name, card number, and validity date. The only difference between these cards is that virtual cards can be used through mobile phone apps.

Virtual cards have gained significant traction in the UAE, offering consumers a convenient and secure alternative to traditional plastic cards. A survey called the Future of Urban Mobility Survey was conducted in the UAE and found that 75% of respondents strongly expect contactless payment options to be available on public transportation.

These digital payment solutions enable users to make online transactions without needing physical cards, enhancing security and reducing the risk of fraud. The popularity of virtual cards is rapidly increasing. Experts predict that the market for these cards will grow to $60.06 billion by 2030 with a compound annual growth rate of 20.7%.Augmented Demand for POS Financing.

Point-of-Sale (POS) financing, a form of short-term lending provided at the point of purchase, is gaining prominence in the UAE. This innovative financing solution allows businesses to offer flexible payment options to their customers, thereby increasing sales and customer satisfaction.

With the rise of e-commerce and evolving consumer preferences for convenient and affordable financing options, the demand for POS financing will witness accelerated growth in 2023.

Dubai has established itself as a leading hub for cryptocurrency and blockchain technology on a global scale. The government’s efforts, such as implementing the Dubai Blockchain Strategy, have provided a solid basis for expanding the crypto ecosystem.

With a proactive regulatory environment and a supportive framework, Dubai has attracted numerous crypto startups and investments, fostering innovation and advancing the adoption of digital assets.

Decentralized Finance (DeFi) and blockchain technology are pivotal in shaping the future of finance in the UAE. DeFi platforms offer decentralized lending, borrowing, and investment opportunities, eliminating intermediaries and providing users greater financial inclusivity.

DeFi’s total market size is growing at 19.03% annual CAGR, reaching $205.45 million by 2027. With its transparency, security, and efficiency, blockchain technology is being leveraged across various sectors, including trade finance, supply chain management, and identity verification, to enhance operational efficiency and unlock new business opportunities.

The UAE’s fintech sector is poised for remarkable growth in 2023, driven by key trends that align with the country’s strategic vision. The government’s commitment to fostering innovation and its supportive regulatory framework has transformed the UAE into a thriving fintech ecosystem.

Moreover, the growth of the fintech industry in the UAE stimulates foreign investments, supports the growth of Micro, Small, and Medium Enterprises (MSMEs), promotes entrepreneurship, and creates employment opportunities for the residents.

As the UAE accelerates its fintech journey, individuals with established expertise in finance can anticipate exciting developments and opportunities in the coming years.

Leverage fintech solutions to pay smarter for your holidays, shopping, or bills with the Letsgo Payit Card and avail of exciting discounts and offers.