Home » Cashless Payments Knowledge Hub » 5 Most Common Digital Payment Methods in the UAE – How You Can Scale Your Business With Them?

As the UAE is leading the GCC region in accepting digital payments to become a cashless economy, businesses from all sectors have also adopted more innovative payment methods.

While the e-commerce industry in the UAE is growing at an accelerated pace to reach $9.2 billion by 2026, payment methods have also changed from cash to cashless digital payments.

Which are the most common digital payment methods? And how can they help you grow your business?

Let’s find out!

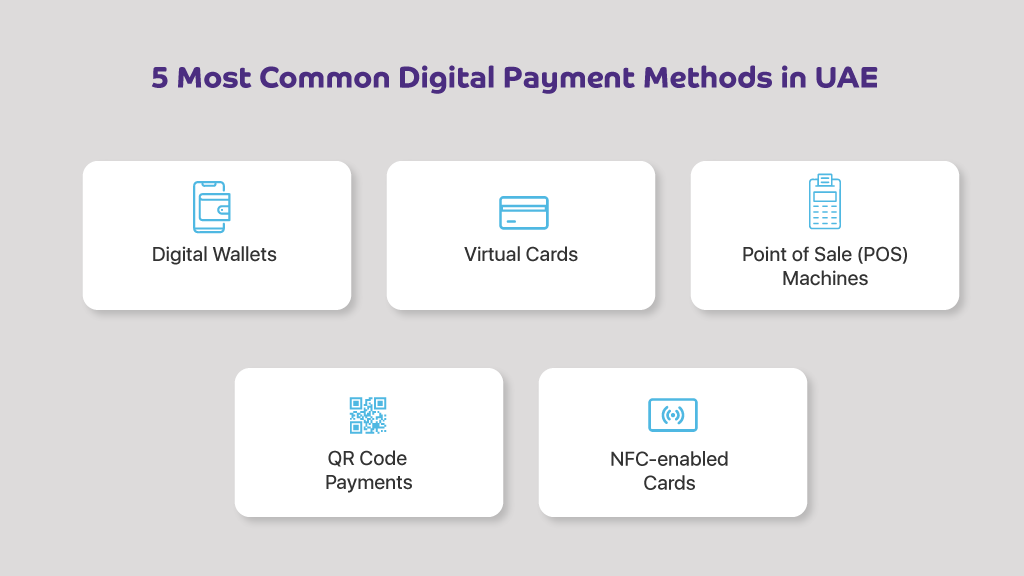

The UAE’s government has also taken steps to make the UAE one of the biggest cashless economies and has framed regulations for safer payments. Let’s see the most common digital payment methods in UAE for businesses.

More than 50% of the UAE’s consumers will go cashless by 2024, and they have already started their march toward going digital for various payments. And digital wallets are one of the most popular digital payment methods in the UAE.

Digital wallets allow you to make one-tap payments through mobile wallets saved in an app on your phone. From card payment, QR code payment, payment links, and sound payments to bill payments, digital wallets allow you to use them anytime and anywhere.

Many e-commerce businesses have also started accepting payments through mobile wallets to increase their customer base. Since when businesses offer their customers their preferred payment methods, there are fewer chances that the customers will abandon the cart.

Payit mobile wallet app lets you send/receive money, make payments, and make international money transfers faster, safer and smarter.

They are similar to physical cards, having a 16-digit unique number, expiry date, and CVV, but are issued electronically. Thus, a virtual card is issued in an app on your phone, and you can use it to shop, dine, pay or receive money just like your credit/debit cards.

Certain virtual card companies issue separate virtual cards that are unique for each transaction and expire upon completion of the transaction. Thus, these cards offer the highest payment security in terms of data privacy and security since, after every use, the card data expires.

POS machines allow you to make payments from anywhere. POS machines are used to make QR code payments, card payments, and mobile wallet payments.

The advantage of having a POS machine at the checkout counter is that it speeds up the payment transaction since the amount to be paid and other details are already transferred to the machine as soon as the invoice is prepared.

Digital payment methods have advanced so well that you can now make payments using a small quick response code known as the QR code. QR code payments offer the convenience of requesting payments from your customers by simply sending them the code to scan and pay the amount.

Many retail stores also keep a QR code at their shops to reduce customer waiting time and speed up the payment processes. The customers scan the code, enter the amount and make payment.

Most credit/debit cards are now issued with NFC (Near Feild Communication) technology. It helps in communicating electronically between two devices within the range of communication. One-tap card payments are done using this technology, one of the most used payment methods in the UAE.

Now that we have covered different types of digital payment methods used in the UAE, let’s see how these methods can help you scale your business.

When you are in an e-commerce business, you know how it hurts when a customer leaves the cart at the last minute (at the time of payment).

The primary reasons why customers do so are

Thus, one of the biggest advantages of having multiple digital payment options is that it helps you grow your business.

Let’s see how else they can help you scale your business.

The digital payment methods come at a budget-friendly cost since they use technology to automate the work of collecting payments. On the other hand, traditional payment methods are expensive, outdated, and cumbersome to process.

Digital payment methods such as mobile wallets are extremely easy to use that offer smooth integration with your business’s payment gateway. Since they use advanced technology to simplify the payment process, businesses find it easy to implement, while the customers also find it simple to process payments.

Related read: How Digital Wallets are Shaping the Future of Digital Payments in the UAE?

Unlike traditional payment methods that are prone to theft, fraud, or other security issues, digital payment methods are safer since they transfer encrypted payment details of a customer. Privacy and security are both robust when businesses use digital payment methods since they have to comply with the data security standards (DSS).

Digital payment methods like digital wallets allow you to also receive payments from other countries in multiple currencies. The way the e-commerce industry is growing, its similar growth in terms of digital payments is necessary to accept international payments.

Sign up for Payit for Business and experience premium features like digital ordering, integrated payments, sound, and QR code payments.

Digital payment methods help you settle your payments faster. Traditional payment methods like cheques take time to process funds and receive them in your bank account. The new digital payment methods can process funds faster to help you receive money quickly in your accounts.

To conclude, adopting multiple digital payment methods is one of the most effective ways to scale your business, especially when you have a larger online presence. As digital wallet spending grows yearly, businesses must constantly add new payment methods to match customers’ expectations and spending habits.